Kaiomu helps traders win regardless of market conditions

Utilize the potential of algorithms for Short operations to borrow and sell tokens at the current market price, allowing you to buy them back at a more advantageous price later on.

Sideways markets

Utilize the power of Matrix bots to take advantage of discounted tokens whenever they reach important support levels. Strategically sell them as they approach significant resistance levels using this intelligent approach, optimizing your trading strategy by capitalizing on crucial price levels in the market.

Bear markets

Make use of Long algorithms to seize opportunities by buying tokens when their prices drop and selling them when they reach peak spikes as their value gradually rises. This strategy enables you to secure a more advantageous average entry price for your positions.

Bull markets

Leverage Long algorithms to capitalize on opportunities by acquiring tokens during periods of declining prices and selling them at peak spikes as the price steadily rises. This strategy enables you to secure a more advantageous average entry price for your positions.

Revolutionary Data Intelligence:

Dominating the cryptocurrency landscape with a decade of multisource data collection since 2013.

- Unrivaled precision in predicting crypto markets through comprehensive data collection from market trends, social, financial and media sources.

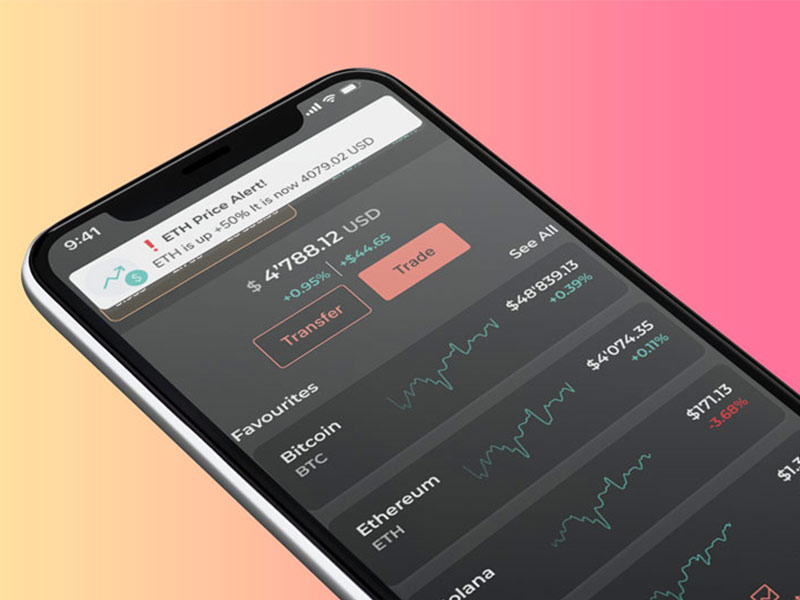

- AI-powered bots can execute trades swiftly and efficiently, taking advantage of market opportunities in real-time. By analyzing historical data, these bots can identify patterns and trends that human traders might miss, leading to more profitable trading decisions.

- AI bots can implement sophisticated risk management techniques, including stop-loss orders and risk limits. These features help protect traders from significant losses and ensure a disciplined approach to trading.

- AI can perform extensive backtesting and optimization of trading strategies.

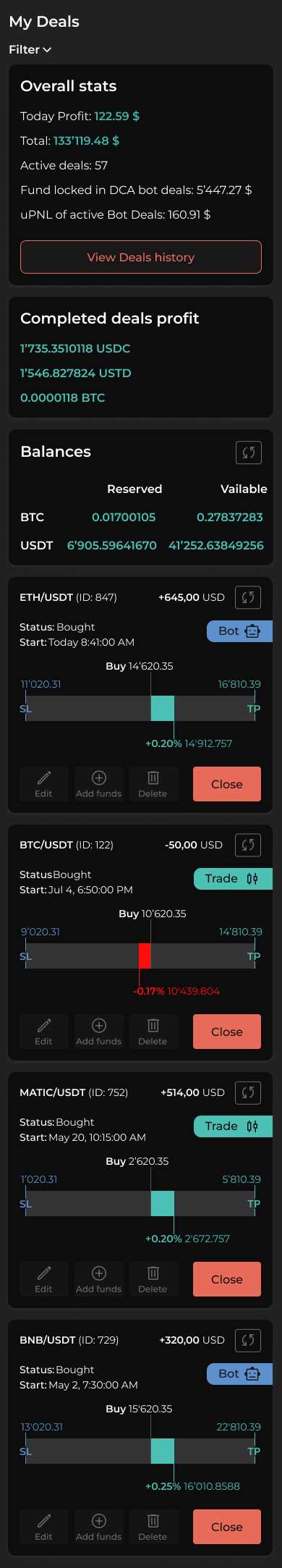

Trading UI made easy for both advanced and beginner traders!

Experience the power of our user-friendly interface that effortlessly eases the pain of trading. Whether you're an advanced user or just starting out, our UI is designed to simplify your trading journey.

We understand the complexities of advanced trading strategies and have incorporated powerful analytical tools, real-time market data, and customizable interfaces to match your specific trading style. Stay ahead of the game with sophisticated charting options, advanced order types, and lightning-fast execution.

Kaiomu Features

Dashboard

Use Short strategies to borrow and sell tokens at the current price and buy them back at a lower price

Bull markets

Add multiple accounts to track your portfolio and check your daily PnL.

Rebalancer

Create portfolios with any coin alocation and rebalance your account with a click.

Demo account

Trade without money. Test strategies safely and without any risk.

Smart Cover

Accrue additional profit with unexpected market moves. Sell and buy back coins.

Options Assistant

A simple set of automated strategies to trade options on an exchange.

Signals

Subscribe to signals provided by other traders to copy strategies.

Happy Clients

Projects

Lines of code

(release branches)

Hard Workers

F.A.Q

Frequently Asked Questions

-

Is a crypto trading bot profitable?

Profitability of trade bots relies on aligning the trading strategy with the prevailing market conditions. With an automated crypto trading bot, a fundamental understanding of current market trends is necessary to select an appropriate strategy. At Kaiomu, we offer a range of tried-and-tested templates designed by seasoned professionals, empowering new traders to create profitable crypto trading bots.

-

How do bots trade crypto?

Automated crypto trading bots function by automating the manual actions a user would typically perform. These bots rely on specific triggers, commonly referred to as signals, to determine the appropriate times to execute buy and sell commands based on the conditions set by the user. Essentially, it follows an "if X, then Y" logic. These signals continuously monitor coin prices through API connections with the crypto exchange and execute the commands as per your predefined conditions when the market conditions align. By utilizing multiple signals, users can create intricate trading strategies that would be cumbersome to execute manually. Some well-known automated trading bots include DCA bots, Grid bots, Futures bots, Options bots, Arbitrage bots, and HODL bots. Each of these bots serves a unique purpose in streamlining and optimizing trading activities in the dynamic world of cryptocurrency.

-

Why should I use bots to trade crypto?

Opting for a cryptocurrency trading bot is the most efficient approach for crypto trading, especially if you intend to do more than simply buy and hold. These bots operate tirelessly, executing your chosen strategy round the clock, freeing you from the need to manually input numerous commands while glued to a computer screen. For instance, leveraging a bitcoin trading bot empowers you to automate the process of buying at low points and selling at high points in response to the ever-changing market conditions. By using bots to trade crypto, your assets are constantly active, generating profits and enhancing the value of your portfolio, rather than being idle in storage.

-

How much does it cost to use a trading bot on an exchange?

The cost associated with using an altcoin trading bot relies on various factors, including the trading fees set by the supported brokerage, like Coinbase Pro. When utilizing an altcoin trading bot on a platform, you can expect to encounter a monthly subscription fee, typically ranging from $14 to $50, depending on the quantity and type of bots you intend to utilize. Moreover, keep in mind that trading fees on crypto exchanges are incurred with every trade, making certain high-frequency trading strategies unprofitable on exchanges with higher fees. Hence, it's essential to consider these factors when selecting the most suitable trading platform and bot setup for your trading preferences and objectives.

-

How much can you make with a crypto bot?

Both bitcoin trading and altcoin trading offer substantial profit potential for traders. Proficient traders gauge their success based on the profit percentage earned from their average trades rather than focusing solely on raw totals. Seasoned traders often achieve profit percentages ranging from 15% to 25% over numerous weekly crypto trades. For newcomers, it's normal to initially experience lower profit percentages as they familiarize themselves with market technical analysis and optimize their bots for improved performance. As you gain more knowledge about technical analysis and fine-tune your bot strategies, your profit percentages are likely to improve, setting you on the path to becoming a successful trader.

-

Does automated trading work better than buying and holding?

Automated trading has demonstrated its effectiveness through millions of successful bot trades. The crucial aspect is selecting a trustworthy trading platform that offers cryptocurrency trading bots with a well-established track record. Transparency is essential, and the platform should readily provide performance data to enable users to create robust trading strategies.

-

How do you set up a crypto bot?

To configure a cryptocurrency trading bot, traders must navigate a series of decisions. Initially, they must choose the type of bot they wish to employ, followed by selecting a suitable crypto exchange. Subsequently, the trader needs to determine the specific trading rules that the bot will abide by, which includes devising a strategy to guide the bot's trading actions and selecting signals that dictate the timing of trades.

-

How much can you make with a crypto bot?

The majority of crypto trading platforms provide a free tier, granting access to 1-2 DCA or Grid bots. This option serves as a cost-effective means for users to familiarize themselves with the platform. However, for traders seeking enhanced efficiency in executing their strategies, upgrading to a paid plan becomes the preferred choice, offering access to more bots.

-

Why can’t I get a paid subscription plan on Kaiomu?

We are still in closed beta to ensure a controlled and limited testing environment before opening up its product or service to the wider public. During the closed beta phase, we offers access only to a selected group of individuals, often including employees, partners and early adopters.

Contact

Contact Us

Location:

1 St Katharine's Way, London E1W 1UN, United Kingdom